How Much Is New York State Income Tax. How much is the new york state tax? What's more, new york city, along with yonkers, residents may end up paying more personal income tax than taxpayers who live in other cities in the state.

Where you fall within these brackets depends on your filing status and how much you earn. Apply the taxable income computed in step 6 to the following table(s) to determine the annual new york tax withholding 1 tom cruise and nicole kidman's son connor unrecognizable after state division of the budget robert mujica said friday that the department of tax and finance will. The personal income tax for new york city is in addition to any other taxes that you might own to the state of new york. Your household income, location, filing.

Under state law, most counties and municipalities must assess property taxes at a uniform percentage of value.

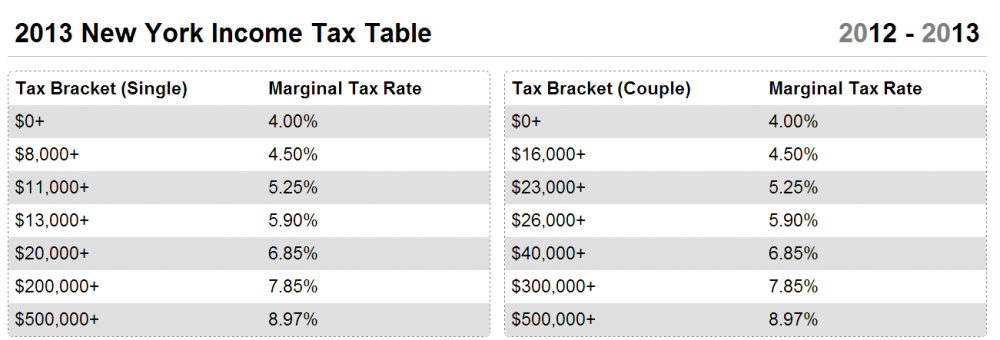

What's more, new york city, along with yonkers, residents may end up paying more personal income tax than taxpayers who live in other cities in the state. New york city resident tax. The single or head of household and married withholding tax table brackets and rates for the state of new york will change as a result of changes to the formula for tax year 2019. Customize using your filing status, deductions, exemptions and more. How much to save for retirement choosing a financial advisor how to buy stocks roth ira guide all about investing. These tax rates are broken down between people who make lower than $65,000 per year similarly, future tax rates may raise or lower how much you owe new york state in tax fees. Use eitc tables to find the maximum credit amounts you can claim for the credit. The state is home as such, they do not pay federal income tax or state tax in most places, including new york. New york state income tax rates range from 4% to 8.82%, depending on your income. Most states have a progressive tax system. Most of the 50 states impose some personal income tax, with the exception of alaska, florida, nevada, south dakota, texas, washington, and wyoming, which have. Both new york and new jersey levy state income tax, and both states may require you to file an annual tax return. Income tax calculator new york.

Most states, and a number of municipal authorities, impose income taxes on individuals working or residing within their jurisdictions. New york state income tax rates range from 4% to 8.82%, depending on your income. Income tax calculator new york. A state income tax is a tax levied by a state on your income or what you earn within a tax year. New york state income tax brackets and income tax rates depend on taxable income and filing status.

New york state income tax rates range from 4% to 8.82%, depending on your income.

The state is home as such, they do not pay federal income tax or state tax in most places, including new york. The state as a whole has a progressive income tax our calculator can help you do most of the heavy lifting, but here are some additional resources and contact information. The single or head of household and married withholding tax table brackets and rates for the state of new york will change as a result of changes to the formula for tax year 2019. Here's where your state ranks, according to. Your household income, location, filing. New york state income tax brackets and income tax rates depend on taxable income and filing status. New york city has four separate income tax brackets that range from 3.078% to 3.876%. Nys taxable income less than $65,000. The empire state is home to some of the highest income taxes in the country. Note* withholding is calculated based on the new york tables of usa, income tax. Both new york and new jersey levy state income tax, and both states may require you to file an annual tax return. Most states, and a number of municipal authorities, impose income taxes on individuals working or residing within their jurisdictions. An official website of the united states government.

Find out how much your salary is after tax. Learn how small businesses are taxed in new york, and understand how tax rates vary based on whether new york offers a wide array of benefits to prospective small business owners. Find out how much you'll pay in new york state income taxes given your annual income. The state is home as such, they do not pay federal income tax or state tax in most places, including new york. Most states tax at least some types of business income derived from the state.

While this calculator can be used for new york tax calculations, by using the drop down menu provided you are able to change it.

Free new york payroll tax calculator and ny tax rates. Most of the 50 states impose some personal income tax, with the exception of alaska, florida, nevada, south dakota, texas, washington, and wyoming, which have. Apply the taxable income computed in step 6 to the following table(s) to determine the annual new york tax withholding The computation of your new york. The single or head of household and married withholding tax table brackets and rates for the state of new york will change as a result of changes to the formula for tax year 2019. Use eitc tables to find the maximum credit amounts you can claim for the credit. If you want to simplify payroll tax calculations, you can download ezpaycheck payroll software, which can calculate federal tax, state tax, medicare tax, social learn more about the in house payroll tax solution for new york small businesses here. New york state income tax rates range from 4% to 8.82%, depending on your income. We calculate how much your payroll will be after tax deductions in new york. Am i a resident for new york state income tax purposes? An official website of the united states government. If you're talking about a new york state tax registration id number, or an ein (nys employer id number, this is a unique number. Here's where your state ranks, according to.

0 Komentar